Today, I am going to show you my complete Bullx Neo Pump Vision walkthrough. And the reason being is, I really feel this is probably the best trading bot for Solana ever made. It doesn’t include a pump fun migration seller, but it has been absolutely incredible so far and outperforms the hell out of Photon. Bullx Neo has increased their speed and added more features than Photon ever had.

Let me guide you through how to get started. First, you are going to need to load up your wallet with Solana-you can copy your Solana address and transfer from an exchange like Binance or bridge it over if your tokens are elsewhere.

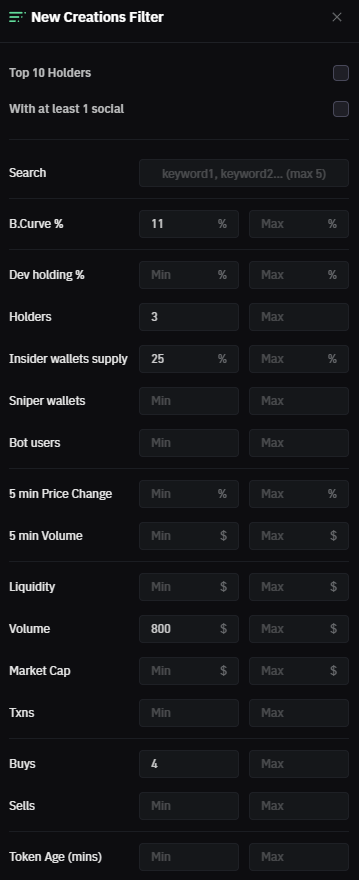

The Filter System:

I would like to give more detail for why I handle certain filters the way I do, and that is the top 10 holders filter defaulting to filtering out tokens where the top 10 hold more than 15%. This to me is too restrictive because, in today’s market, in fact, with new tokens, it is quite normal to have 20-25% concentration in top holders, and you might miss good opportunities if you filter these out.

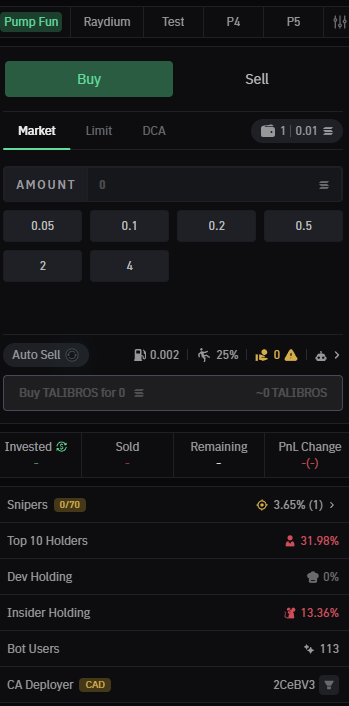

Trading Settings Deep Dive:

Let me detail my trading parameters in greater detail:

- For quick buys, I set preset buttons at 25, 50 cents intervals

- Priority fees are crucial: 0.002 is my baseline for beginners, but here’s what I adjust to:

- For high volume: increase to 0.1

- For very competitive tokens: might go up to 0.5

- Slippage settings: I stick to 15% for safety, but in high-volume situations, I might adjust to 40-50%

Order Types Explained:

I should mention more about each order type:

- Market orders: These execute at current price, which I used in my demo buy at around 10K market cap

- Limit orders: You can set specific price targets. I showed setting a buy at 11K market cap

- DCA (Dollar Cost Average): I demonstrated setting up 30 orders of 0.1 SOL each hour, which is great for accumulating positions in tokens you believe in long-term

Advanced Features:

The terminal has some really useful data points I didn’t fully explain:

- Smart wallet tracking: Shows you what successful traders are doing

- Bot users: You can see which wallets are using trading bots

- Inside trading detection: Shows if there’s suspicious trading activity

- Holder analysis: Breaks down not just numbers but wallet behaviors

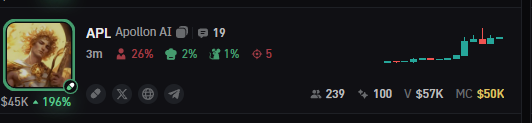

Charts and Real-Time Data:

The charting system is more sophisticated than I initially explained:

- 5-minute price changes can be filtered (useful for catching momentum)

- Volume indicators show real-time trading activity

- You can set alerts for specific price movements

Sniper Detection Features:

This is particularly powerful because:

- Tracks first 70 buys into a token

- Shows which early buyers are still holding

- Helps identify if a token is genuinely accumulating or if it’s just wash trading

- Can reveal if dev wallets are selling

Trading Strategy Implementation:

For actual trading, here’s my approach:

- Use market orders for quick entries in fast-moving situations

- Set limit orders slightly below market for dips

- Use DCA for longer-term positions

- Always monitor the sniper dashboard for early holder behavior

Risk Management:

One thing I should emphasize is my approach to risk management:

- Never set slippage too high (stay under 15% for regular trades)

- Monitor holder concentration regularly

- Watch for sudden increases in bot activity

- Check social links but don’t rely on them exclusively

Putting these together, Bullx Neo Pump Vision is a very powerful tool that becomes even more powerful with recent improvements in speed. There are some reliability issues with Bullx servers, but overall, the functionality makes it worth having to deal with intermittent downtime.

Leave a Reply