In this video, I explained why you need to adopt a VC-like investing philosophy when investing in meme coins and why new traders should not trade on pump.fun. Let me break down my key points:

I explained that VCs usually invest in several companies, expecting only one to outperform the rest by a landslide. That would be like Peter Thiel’s investment in Facebook. The same should be done with the mentality of meme coins: you’ve got to understand that some might do a little better and some a little worse, but one token could outperform all others combined.

In my experience, coins which actually reach a market cap of 200-500 million probably appear once every two weeks. Then, when you haven’t had a big runner for a week or week and half, it is then you should be starting to look closely – people get impatient and will push something new.

I shared some important statistics: out of 1.7 million coins launched On pump.fun, only about 1.4% make it to Raydium, which is approximately 1 in 80 coins. For new traders, I strongly advise against trading on pump.fun unless you have a lot of free time. Otherwise, I think it’s much better to focus on coins after they’ve reached Raydium, since coins that can maintain a million market cap for a few weeks have almost a 40% chance of hitting 10 million market cap later.

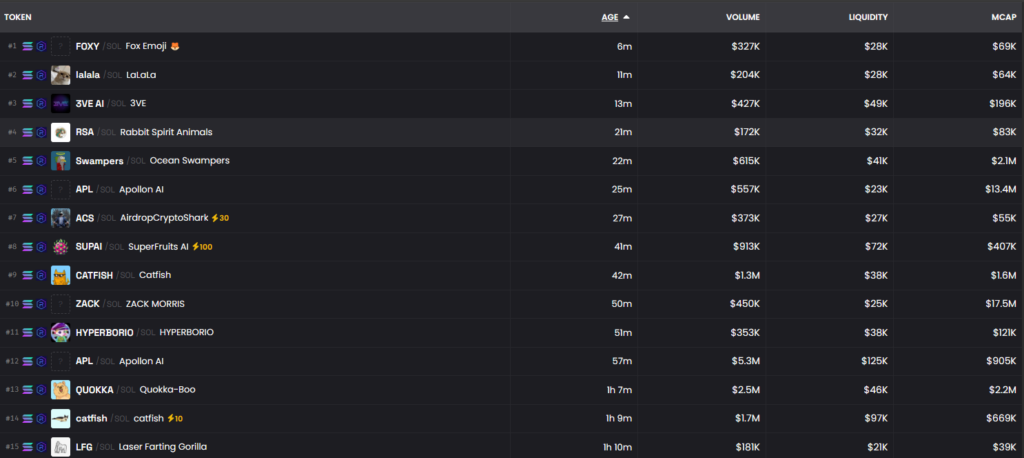

Then I showed how I do my daily scans via DexScreener’s perfect new pairs filter, going through a lot of coins and explaining why and how I would consider the following: whether the token is a valid pump.fun token; whether the meme is normie-friendly-this is vital for mass adoption; whether it is CT native or retail-native coin. I also touch on how similar memes have been done and what the socials and website are like for the project.

During my scan of about 8 hours’ worth of new coins, I actually didn’t find anything I wanted to invest in immediately, just several coins I added to my watchlist for further research. That is how selective you need to be. I usually invest in 2-3 coins per day, but only after thorough evaluation.

I recommend giving each coin about a week to run, though you usually start seeing traction after 3 days. For risk management, I suggested setting limit orders to take your initial investment out at 2x, or setting stop-losses at -50%.

The key takeaway I wanted to share is understanding what makes coins successful before putting money into pump.fun. Trade in reverse: learn what goes up, then you can identify good opportunities at the bottom instead of risking your money on coins that might not even make it to Raydium.

Leave a Reply