Today in the video, I talked about how to trade using Fibonacci retracement, specifically within cryptocurrency markets. I centered my attention on how this tool helps in assessing support and resistance levels where the coins might show a bounce-back.

I highlighted two pivotal Fibonacci levels-0.382 and 0.618-as the most important price levels for understanding where buyers might react. At its core, what we’re really trading is charts of human emotion, with fear and greed on display in the price action.

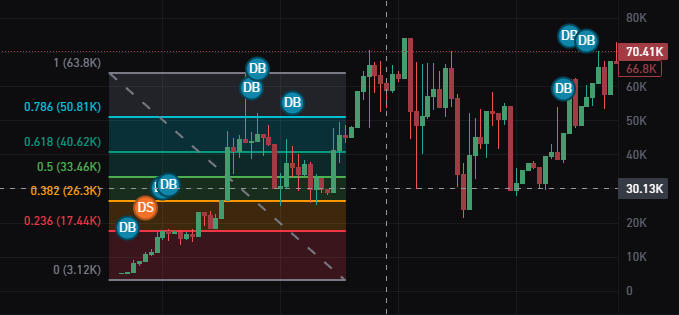

Using a real example of a new coin, I showed how to set up the Fibonacci retracement tool. I showed how the “1” level is to be put at the peak and the “0” level at the bottom of the starting point. I’m usually looking for a 60% drop from the swing up to the all-time high, and if I’m bullish on a token, I usually place my limit orders around the 0.382 level.

I mentioned how, in our example, the bounce from the 0.236 level was really sharp, meaning a lot of traders likely set limit orders at that level. Also, how I was correct to predict the all-time high of the coin, somewhere around 58 million, using the 1.618 extension level.

I explained that Fibonacci retracements work particularly well with meme coins because most of the traders within this space are not using technical analysis, while in traditional markets, traders could actively trade against these levels. Above 10 million market cap, I actually find it pretty easy to forecast price movements by using these tools, though they can work even below 100k if volume is sufficient.

In the current analysis of this coin, I’ll be looking to buy at the 0.382 level. I usually set multiple buy orders from 28 million up to 20 million, increasing my position size as the price goes lower. Other traders set a stop loss around the 0.236 level; I actually view it more as an area for a buying opportunity if it were to drop that low.

I projected that the coin could reach around 90 million, though I expect it might take about a week and won’t happen immediately. I also said, “It’s very important to have conviction in the coins you’re trading with Fibonacci retracements-you can’t just apply this to any random coin. You still need to consider fundamentals, especially with meme coins, which are heavily influenced by narratives and community sentiment rather than just technical indicators.

Leave a Reply